Is your M&A business a success, or has it been eroding your company? Most companies share common M&A goals to gain market share, eliminate competition, and add products and services to their corporate portfolio. It makes sense. Acquiring companies can quickly convey a path to increased value. However, once a company purchases another, sometimes the underlining reasons that would make the acquisition successful are lost in transition. Company’s Policies, Culture, Systems and Processes (PCSPs) can bring as much value to the purchasing company as the products and services themselves, but they don’t always make the cut.

Because of investor and board commitments, many companies use a rip and replace strategy to eliminate: extra costs, redundancy, and unalike business practices. Though there are some proven advantages in executing this approach, have you asked yourself if it really creates a cohesive business? Many times, it can result in wide-spread issues and abolished PCSPs. Some of the very things that made the acquired company successful and would provide a competitive advantage to the newly merged company no longer exist. Other companies take a multi-tiered approach by using a combination of strategies, incorporating acquired PCSPs. Though they have good intentions, this is not always a straightforward process. When trying to put a square peg in a round hole, it can lead to enterprise issues. Business and IT Executives find themselves trying to manage a daunting task that if miscalculated, can result in employee adoption and customer acceptance problems, diminishing the company’s growth potential.

It’s a lot of pressure to endure. In many cases, executing the perfect M&A strategy in an imperfect situation falls into the laps of CIOs, as IT systems are integrated. They find themselves afflicted with the old proverbial in-between a rock and a hard place. On the one hand, CIOs feel they need to rip and replace systems, appeasing the board in mitigating risk and cost. On the other hand, CIOs know this will cause endless complaints from different business divisions that can no longer do their job due to; missing data, processes not built for their needs, and applications are either foreign or too complex to use. A mishap in managing this transition could not only hurt the company but could cause career hurdles for all teams involved.

Instead of weighing out the need to rip and replace against business requirements, why not achieve success in both areas? With today’s technology, it does not have to be a this or that, or even a fully defined path. You can think outside of the box. Perhaps using a platform that is flexible enough to incorporate your replaced systems but is also fluid sufficient that it adjusts to current acquired and future PCSPs, is the road to success. Think of the acquisition process as a living environment, where the CIO can provide tools to the business, it can also embrace the change, while still functioning in the manner it needs, to save costs and preserve any competitive advantages from the acquisition.

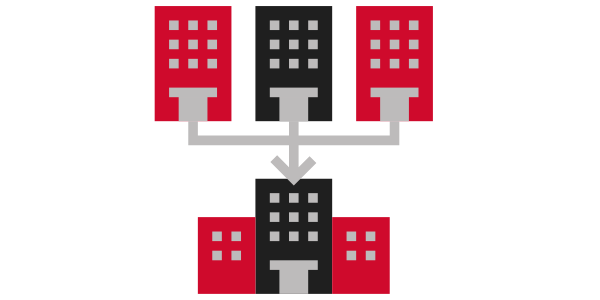

So where do you begin? The first area to consider is the leveraging of both company’s infrastructures. No doubt there will be redundant systems where a rip and replace approach makes a lot of sense. But what if you could share the remaining systems with both companies to improve business as a whole. Would this appeal to your board, your business leaders, and even your customers? For example, reusing a process engine from one of the companies to manage all processes enterprise-wide. Each business unit or former company could still maintain the same procedures that helped run their business but have them based off one method and rules engine. What if this engine could provide process mining dashboards so that the company processes can be improved upon on a regular basis? Would that change the outcome of your M&A transition? Now you are not just focusing on the business needs from both companies but providing them a means for ongoing improvement. Next, let’s look at data. It no longer must be siloed. Make data access easy no matter who needs to use it. Combine both company’s data either by centralizing it, or leaving it in place crossing existing OnPrem, Cloud and Hybrid Cloud sources from both companies. The ability to easily use data becomes a non-issue. Finally, instead of maintaining endless custom-built applications, why not implement a means which allows you to configure applications as needed, mimicking custom application UIs from both companies, giving everyone what they want and allowing them to work in a manner they are accustomed too. User adoption rises, while you can still eliminate redundancy, extra costs, and the headaches of managing disparate systems. Today is the future. The role of the CIO has drastically changed. No longer do you have to take a reactive approach to M&A transitions. You can use the acquisition as a foundation to help the newly merged company not only function in the desired manner of the purchase itself but help enable the business to grow without tedious disruptions.