In today’s digital age, insurance companies face numerous challenges when it comes to managing and organizing vast amounts of information. The efficiency and productivity of insurance operations heavily relies on the effective management and accessibility of content. Traditional paper-based systems are rapidly being replaced by content management repositories that offer centralized storage and seamless integration.

Streamlined Document Capture and Storage

Insurance companies deal with an enormous volume of paperwork, ranging from customer applications and policy documents to claim forms and legal contracts. The traditional process of manual data entry and filing is time-consuming and prone to errors, leading to decreased productivity and potential compliance issues. Many companies went on to implement first-generation CRM’s, which mostly stored information in a central location. However, with lack-luster versioning abilities and a lack of security it caused issues with compliance and duplicate information.

By implementing a well-integrated content management repository like Intellective’s Unity Suite, insurance companies can streamline the document capture and storage process. Intelligent capture technologies can automatically extract data from incoming documents, reducing manual data entry and improving accuracy. The documents are then securely stored in a centralized repository, making them easily accessible to authorized personnel.

Intellective’s Unity Suite allows you to search all of the information in your company from one interface. You can find, act, and save your work in a document without ever switching windows. Plus, with additional note capabilities you can interact with coworkers from within the document.

Improved Document Retrieval and Collaboration

Efficient access to information is crucial for insurance companies to provide timely service and make informed decisions. Searching through physical files or navigating through multiple disconnected systems can be frustrating and time-consuming. This is where content management repositories shine.

With better integration, insurance professionals can quickly retrieve relevant documents using advanced search capabilities. Full-text search, metadata filtering, and document tagging streamline the retrieval process, enabling employees to access critical information within seconds. Furthermore, integrated repositories facilitate collaboration by allowing multiple users to work on the same document simultaneously, eliminating the need for time-consuming manual handoffs.

Enhanced Workflow Automation

Insurance workflows often involve multiple steps and require collaboration between different departments. Manual processes and paper-based workflows can introduce bottlenecks, delays, and human errors, resulting in decreased productivity and dissatisfied customers.

By integrating content management repositories with workflow automation tools, insurance companies can optimize their operations. Workflows can be designed to automate routine tasks, such as policy renewals or claims processing, reducing manual intervention and accelerating turnaround times. Notifications and alerts can be set up to ensure that tasks are completed on time, enhancing productivity and improving customer satisfaction.

Seamless Integration with Third-Party Systems

Insurance companies rely on various external systems and applications, such as policy administration systems, underwriting tools, and customer relationship management platforms. However, working with disjointed systems can lead to data silos, redundant data entry, and inefficiencies.

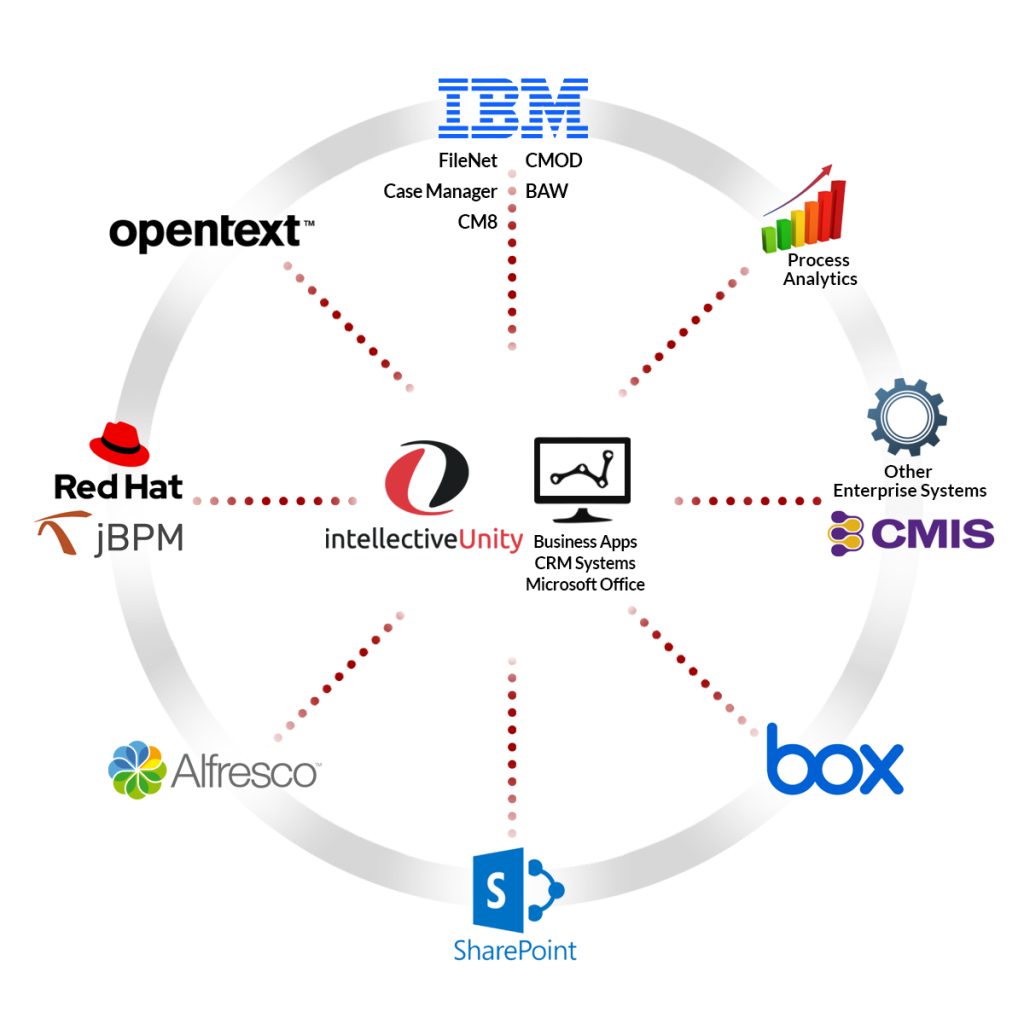

Better-integrated content management repositories enable seamless integration with third-party systems, creating a unified and connected ecosystem. This integration allows for the automatic extraction and synchronization of data between different applications, reducing duplicate data entry and ensuring data consistency across systems. By eliminating data silos and improving information flow, insurance professionals can access critical data from a single source, boosting productivity and minimizing errors.

Enhanced Compliance and Risk Management

The insurance industry is heavily regulated, and compliance with regulatory requirements is of utmost importance. Failure to comply can result in severe penalties, damaged reputation, and legal implications. Moreover, insurance companies need to manage risks associated with data breaches and unauthorized access to sensitive information.

A robust content management repository like Unity offers advanced security features, such as role-based access control, audit trails, and encryption. These features not only safeguard confidential data but also assist in compliance with industry regulations like GDPR or HIPAA. Additionally, integration with records management systems enables the proper retention and disposal of documents, ensuring compliance with document lifecycle requirements.

Conclusion

In the highly competitive insurance industry, optimizing productivity and efficiency is essential for success. By embracing better-integrated content management repositories, insurance companies can overcome the challenges posed by traditional paper-based systems, or those of legacy systems.